MT4 in 2026: why it refuses to die

MetaQuotes stopped issuing new MT4 licences some time ago, steering brokers toward MT5. Yet most retail forex traders stayed put. The reason is straightforward: MT4 does one thing well. A huge library of custom indicators, Expert Advisors, and community scripts only work with MT4. Switching to MT5 means rebuilding that entire library, and the majority of users don't see the point.

I spent time testing MT4 and MT5 side by side, and the gap is smaller than you'd expect. MT5 adds a few extras such as more timeframes and a built-in economic calendar, but chart functionality is very similar. For most retail strategies, MT4 still holds its own.

Getting MT4 configured properly the first time

Installation takes a few minutes. Where people waste time is getting everything know more configured correctly. Out of the box, MT4 loads with four charts squeezed onto the screen. Clear the lot and open just the instruments you actually trade.

Save yourself repeating the same setup by using templates. Configure your go-to indicators on one chart, then right-click and save as template. Then you can load it onto other charts instantly. Sounds trivial, but over time it adds up.

Something most people miss: go to Tools > Options > Charts and enable "Show ask line." The default view is the bid price on the chart, which makes your entries look off until you realise the ask price is hidden.

How reliable is MT4 backtesting?

MT4 comes with a backtester that gives you the ability to run Expert Advisors against historical data. But here's the thing: the reliability of those results depends entirely on your tick data. Standard history data is not real tick data, meaning the tester fills gaps mathematically. For anything more precise than a quick look, grab proper historical data.

The "modelling quality" percentage is more important than the profit figure. If it's under 90% indicates the results are probably misleading. I've seen people share screenshots with 25% modelling quality and can't figure out why their live results don't match.

This is one area where MT4 genuinely outperforms most web-based platforms, but only if you feed it decent data.

Building your own MT4 indicators

MT4 ships with 30 built-in technical indicators. Most traders never touch them all. However the platform's actual strength lives in user-built indicators coded in MQL4. You can find over 2,000 options, ranging from simple moving average variations to elaborate signal panels.

Adding a custom indicator is simple: place the .ex4 or .mq4 file into your MQL4/Indicators folder, refresh MT4, and the indicator shows up in the Navigator panel. The catch is reliability. Publicly shared indicators range from excellent to broken. Some are solid tools. Many are abandoned projects and will crash your terminal.

Before installing anything, look at the last update date and whether people in the forums have flagged problems. A poorly written indicator doesn't only show wrong data — it can freeze the whole terminal.

Risk management settings most MT4 traders ignore

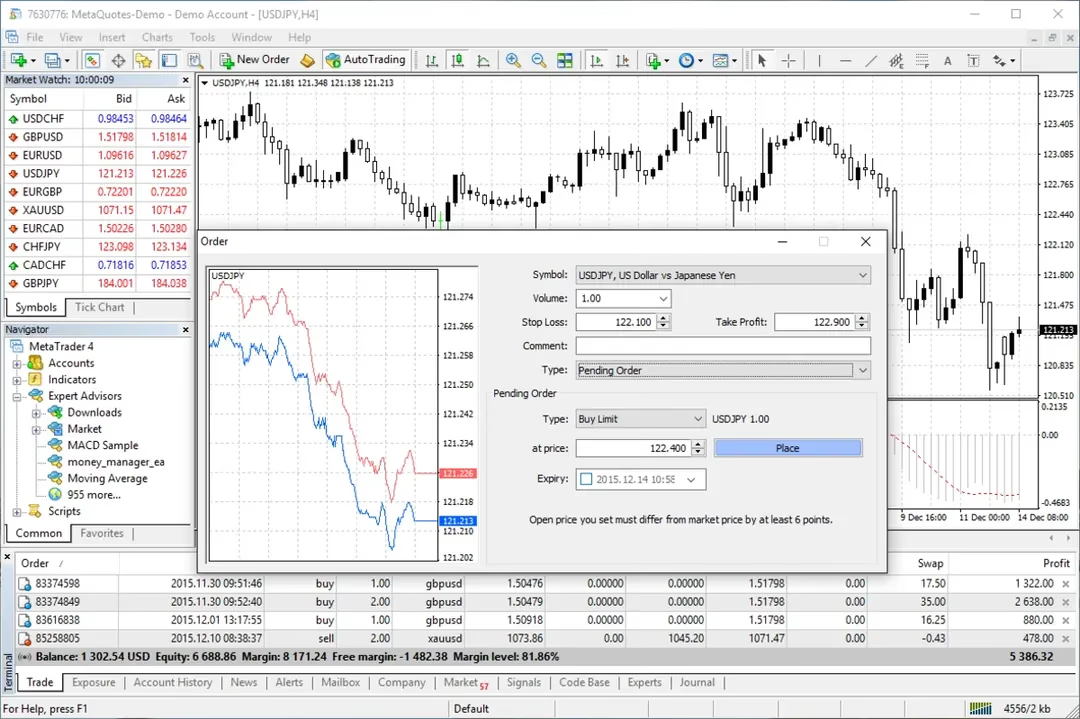

There are a few native risk management tools that most traders skip over. Probably the most practical one is the maximum deviation setting in the trade execution window. This controls how much slippage you'll accept on market orders. Without this configured and the broker can fill you at whatever price comes through.

Stop losses go without saying, but MT4's trailing stop feature are worth exploring. Right-click an open trade, choose Trailing Stop, and set the pip amount. The stop follows automatically as price moves in your favour. It won't suit every approach, but for trend-following it removes the need to sit and watch.

None of this is complicated to set up and the difference in discipline is noticeable over time.

Running Expert Advisors: practical expectations

Automated trading through Expert Advisors have obvious appeal: set rules, let the code trade, walk away. In practice, most EAs lose money over any meaningful time period. EAs sold with perfect backtest curves are often fitted to past data — they look great on the specific data they were tested on and fall apart the moment market conditions change.

None of this means all EAs are useless. Certain traders build personal EAs to handle specific, narrow tasks: entering at a specific time, automating position size calculations, or closing trades at fixed levels. That kind of automation tend to work because they do repetitive actions that don't require discretion.

If you're evaluating EAs, run them on a demo account for at least several weeks in different conditions. Running it forward in real time tells you more than backtesting alone.

MT4 on Mac and mobile: what actually works

MT4 is a Windows application at heart. Running it on Mac face compromises. Previously was running it through Wine, which mostly worked but introduced display glitches and occasional crashes. Certain brokers now offer Mac-specific builds using Wine under the hood, which are better but still aren't true native apps.

The mobile apps, on both iPhone and Android, work well for keeping an eye on open trades and managing trades on the move. Full analysis on a mobile device is pushing it, but managing exits while away from your desk has saved plenty of traders.

Look into whether your broker has a native Mac build or just a wrapper — the difference in stability is noticeable.